Current Tax Slabs (FY 2010-11):

- Income upto an annual sum of Rs.1,60,000 is tax free.

- Income in the range of Rs.1,60,001 to Rs.5,00,000 is taxable at a rate of 10%

- Income in the range of Rs.5,00,001 to Rs.8,00,000 is taxable at a rate of 20%

- Income above Rs.8,00,001 is taxable at a rate of 30%

Tax Slab Raised

For the fiscal 2011-12, the FM has tweaked only the threshold income tax limit at the lowest levels of the slab which affects the commonest of the aam-aadmi. The new proposal has enhanced the exemption limit for the general category of individual tax-payers from Rs.1,60,000 to Rs.1,80,000; which will be uniform for both men and women. This will provide a uniform tax relief of Rs.2000 to every tax payer of this category.

Incremental Sops for Senior Citizens

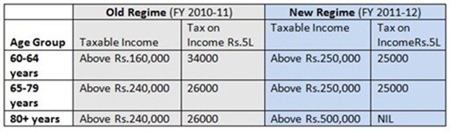

The Union Budget 2011 has been generous for the citizens of the age group from 60 years and above. Pranab’daannounced special category of tax-paying senior citizens. The biggest beneficiaries are those aged 80 years or more.

Income Tax Calculations

The most pleasant news for the higher-aged tax-payers being FM’s reducing the qualifying age, from 65 years to 60 years, to be termed as Senior citizens under the Income Tax Act. Moreover, Pranab Mukherjee has also raised the exemption limit from Rs. 2,40,000 to Rs. 2,50,000 for this age-group people.

The buck doesn’t stop here! He also introduces a special category of ‘Very Senior Citizens’ – for 80 years and above – who will be eligible for a bountiful higher tax exemption of Rs.5 lakh. Its party time for them… and they do deserve it!